The Italian Hedge: Why Some HNWIs Are Allocating 5% to Classic Ferraris

Ferraris in Portfolios? Yes, Really.

Mention “Ferrari” and most minds go to speed, status, and style—not capital preservation. But in 2025, a quiet shift is underway. From Zurich to Dubai, HNWIs and their wealth managers are treating rare Ferraris not just as trophies—but as tangible hedge assets.

In this article, we examine why a strategic 3–5% portfolio allocation to classic Ferraris is gaining traction, how it compares to traditional alternatives, and what role platforms like aShareX play in streamlining access to this exhilarating asset class.

Why Allocate 5%? The Role of Tangible Assets in Modern Wealth Strategies

Let’s start with asset allocation theory. In a diversified portfolio, 5–15% is typically reserved for alternative investments—assets outside stocks and bonds. Tangibles like real estate, art, and collectibles sit within that bucket.

So why would someone choose Ferraris?

Because they offer:

- Low correlation with public markets

- Scarcity-based appreciation

- Inflation resistance

- Cultural value and status alignment

Adding just 3–5% in classic Ferraris introduces anon-correlated, finite asset—ideal for balancing volatility and protecting long-term wealth.

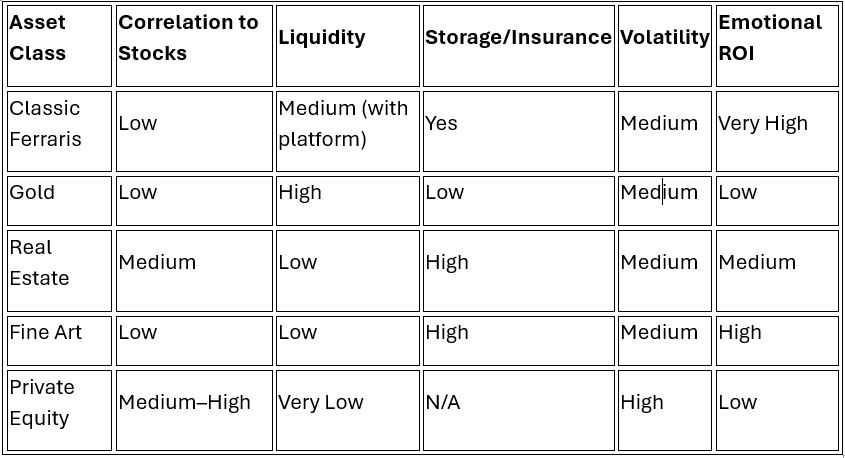

Ferrari vs Traditional Alternatives: A Comparative Snapshot

Ferraris may not replace these assets—but they can strategically complement them with unique upside and collector cachet.

The Ferrari Advantage: What Makes the Asset Class Stand Out

1. Finite Supply Meets Timeless Demand

Ferrari doesn’t mass-produce. Investment-grade models are often made in runs of 1,000 units or fewer. Add to that natural attrition, and the investable universe is razor-thin.

Meanwhile, demand is deep and global:

- A new class of Millennial HNWIs view Ferraris as cultural investments

- Classic car events and auctions are expanding across continents

- Museums and foundations are actively acquiring

2. Cultural and Emotional Capital

Ferraris combine aesthetics, innovation, history, and identity. For HNWIs seeking meaning behind their wealth allocations, a Ferrari isn’t just a car—it’s a legacy asset.

3. Historical Appreciation

According to Hagerty and Knight Frank data:

- Certain Ferraris have appreciated 10–15% CAGR over two decades

- The Ferrari 288 GTO saw values grow from ~$200K in the 1990s to $3M+ in 2020s

- The 250 GT Lusso has tripled in value since 2009

Access Has Changed: Enter aShareX and Fractional Ferrari Ownership

In the past, Ferrari investing required:

- Millions in capital

- Insider dealership networks

- Specialized knowledge

- Garage space, maintenance, insurance

Not anymore.

With platforms like aShareX’s Classic Automobiles Alternative Investment, qualified investors can:

- Invest from $2,500+

- Get access to verified, investment-grade Ferraris

- Enjoy concierge custody, maintenance, and reporting

- Trade via a regulated secondary market

It’s Ferrari investing without the overhead—designed for modern portfolios and global investors.

What Makes a Ferrari Portfolio-Ready? Criteria Checklist

To be eligible for a wealth-managed portfolio, a Ferrari must check several boxes:

- Low production count (ideally <1,000 units)

- Cultural and design significance

- Ferrari Classiche or concours potential

- Documented service history

- Documented ownership

- Strong price trajectory via auctions

Bonus: Vehicles with race heritage, celebrity provenance, or unique configurations command an extra premium.

Portfolio Integration: Tips from Wealth Managers

- Don’t Over-Allocate

Stick to 3–5% of total investable assets. Ferraris are illiquid compared to stocks or REITs. - Use Platforms for Diversification

Fractional access allows exposure to multiple models, eras, and price bands. - Track the Holding Horizon

Classic Ferraris often shine over 5–10 years, not in 12-month flips. - Consider Emotional and Legacy Value

Some investors use Ferrari assets as heirloom or gifting strategies—blending financial and emotional ROI.

Emerging Trends: The Ferrari Future Is Bright Red

1. Millennial Wealth Shifts

As wealth transfers to younger generations, their investment style differs:

- They value experiences, stories, and culture over commoditized assets

- Digital platforms make collecting easier

- ESG and traceability matter—even in car investments

2. Cross-Asset Platforms

Expect Ferrari shares to sit alongside:

- Fine art portfolios

- Royalties and music rights

- Income-generating luxury real estate

Platforms like aShareX are leading this convergence—creating intuitive dashboards for tangible wealth.

Downside Risks—and How to Mitigate Them

Ferrari investing isn’t risk-free. Key concerns include:

- Market cooling in the collector segment

- Regulatory changes in cross-border ownership

- High restoration or insurance costs if directly owned

- Difficulty in resale without platform support

Mitigation: Work with platforms that provide:

- Custody, storage, and maintenance

- Regulated exit paths

- SEC-compliant offering structures

- Transparent asset due diligence

The Ferrari Flywheel: When Culture, Scarcity and Wealth Align

Why does this strategy work? Because it blends three rare forces:

- Cultural Gravity

Ferrari isn’t just a brand—it’s a global symbol of legacy, craftsmanship, and aspiration. - Hard Scarcity

Unlike shares or crypto, you can't mint more 288 GTOs. - Wealth Utility

The asset doesn’t just sit in a vault. It creates experiences, statements, and connection—especially when held through platforms offering events, community, or showcases.

The Portfolio of the Future Includes Emotion

In a world where volatility is a click away and AI can trade your ETFs, there’s value in holding assets that stir something deeper.

Classic Ferraris sit at the intersection of art, engineering, story, and wealth. When integrated wisely, they serve not just as hedges—but as reminders of the passions wealth is meant to unlock.

So the next time your wealth manager says “alternative allocation,” you might want to whisper back: “How about something Italian?”

Leave a Comment